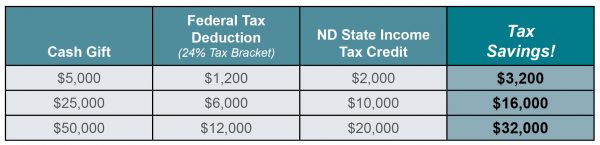

The state of North Dakota allows for a direct credit against taxes for individual and corporate gifts made to qualified endowments. Individuals and businesses paying North Dakota income tax may qualify for a 40 percent tax credit with a minimum gift of $5,000 or more to our endowment.

- Businesses: The maximum tax credit is $10,000.

(This includes C corporations and S corporations, estates, limited-liability companies, trusts and financial institutions). - Individuals: The maximum tax credit is $10,000 per year—per taxpayer, or $20,000 per year—per couple filing jointly. (An adjustment must be made to increase North Dakota taxable income by the amount the contribution reduced the individual’s federal taxable income. If the credit exceeds the individual’s tax in the tax year the contribution is made, the excess credit may be carried over and used on subsequent tax year’s returns for up to three years.)

A gift directed to our endowment helps us provide specialized care to our patients, support to their families and the communities we serve, not only today, but also ensures the long-term viability of Hospice of the Red River Valley.

- Qualifying gifts to our endowment, whether lump sum or aggregated throughout the tax year, benefit you through a 40 percent North Dakota state income tax credit.

- Your gift provides a guaranteed source of income for Hospice of the Red River Valley to help meet our future needs.

For more information, contact a member of our philanthropy team at (800) 237-4629.

*Your federal tax savings will vary according to your individual circumstances. You will want to contact your own financial advisors for tax savings specific to your situation.